Accept payments and securely with Bolt’s enterprise-grade payments processing solution as your payment facilitator or keep your existing payment processor through a simple gateway integration.

TIP

To set up Bolt Payments as a payment facilitator, you’ll proceed through a streamlined onboarding flow that differs from the setup for payment service providers (PSPs).

Add Payment Processor to Bolt

REQUIREMENTS

Merchants may choose a payment processor during the onboarding phase. Existing merchants can also migrate to a different processor by using the steps outlined in the related articles.

- Log into the Bolt Merchant Dashboard.

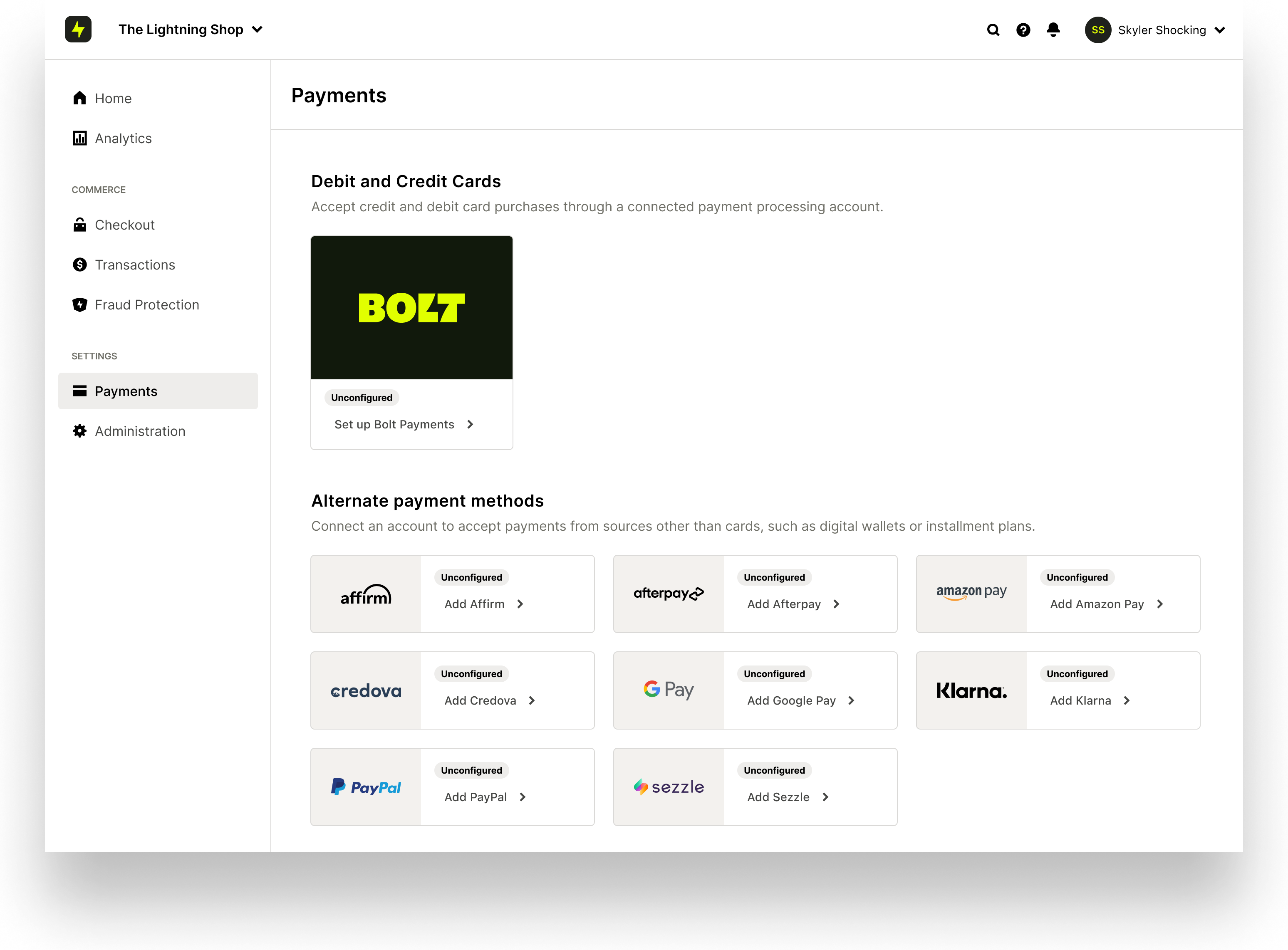

- Navigate to Settings > Payments.

- The payment processors available for you to add appear in the Debit and Credit Cards section.

- Add account keys. The information you need varies depending on which processor you choose; refer to the Processor Setup Guides.

- Configure payment settings to customize how payment processing works.

- After you complete set-up, you will see your active processor listed in the Payments section page of the dashboard.

TIP

To perform processor setup steps, you must be an admin in your Bolt Merchant Account.

Configure Processor Risk Settings

When a shopper uses a saved card, Bolt does not transmit CVV data to processors. Configure risk settings so the lack of this data does not trigger auto-declines:

- Log into your payment processor account.

- Allow transactions that do not include CVV match data.

For steps specific to your processor, see Processor Setup Guides.

WARNING

If you don’t use Bolt’s Fraud Protection product, contact your fraud solutions provider to inform them that payments transmitted via this processor will not provide CVV match information.

Implementation Overview

Timeline

The processor implementation timelines average 2-4 weeks. Factors include the speed of communication between you and Bolt and the complexity of your account. Bolt’s Success team can offer timeline estimates for each merchant.

Details Required

| General Requirements | If Direct Debit |

|---|---|

| Business Name | Company name registered with Bank |

| Address | Bank Branch Name |

| Company’s Customer Service Phone Number | Bank Routing Number |

| Company’s Customer Service Email | Bank Account Number |

| Website URL | |

| Time Zone | |

| Support Email | |

| Support Phone | |

| Contact (Name, Title, Email, Phone) |