📍

Bolt Help / Fraud & Risk / View Risk Scores

Access risk scoring information for each merchant-liable card transaction. All merchants are eligible for this feature, whether they have Fraud Protection or not.

Access Risk Assessment Scoring information for each merchant-liable card transaction in the Bolt Merchant Dashboard.

How to View Risk Scores

- Log in to the Bolt Merchant Dashboard.

- Navigate to Transactions.

- Click a transaction to view its details.

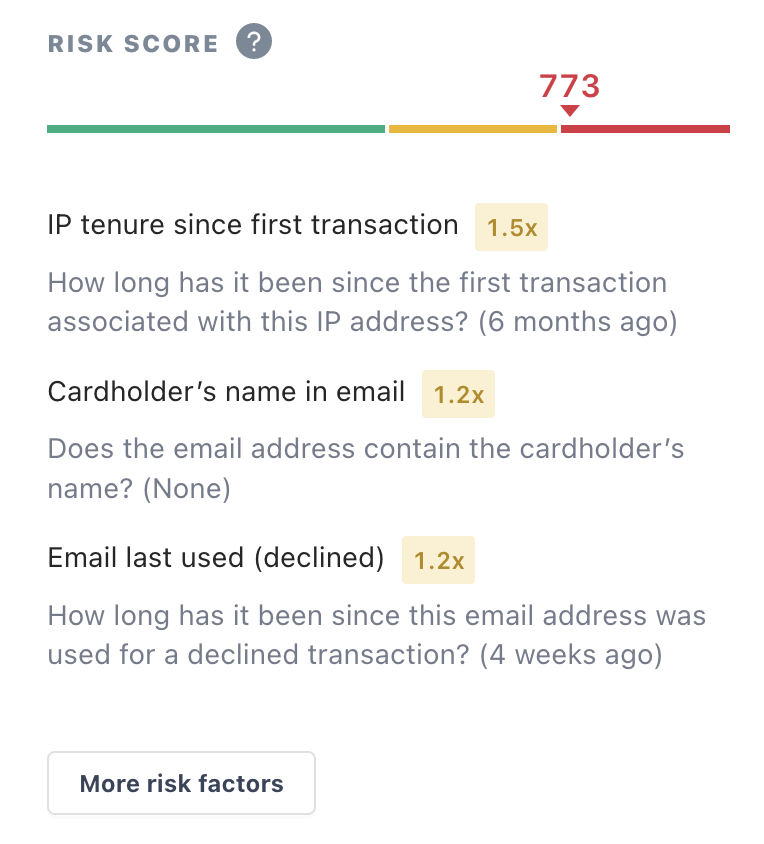

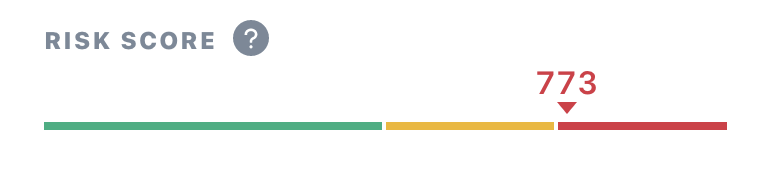

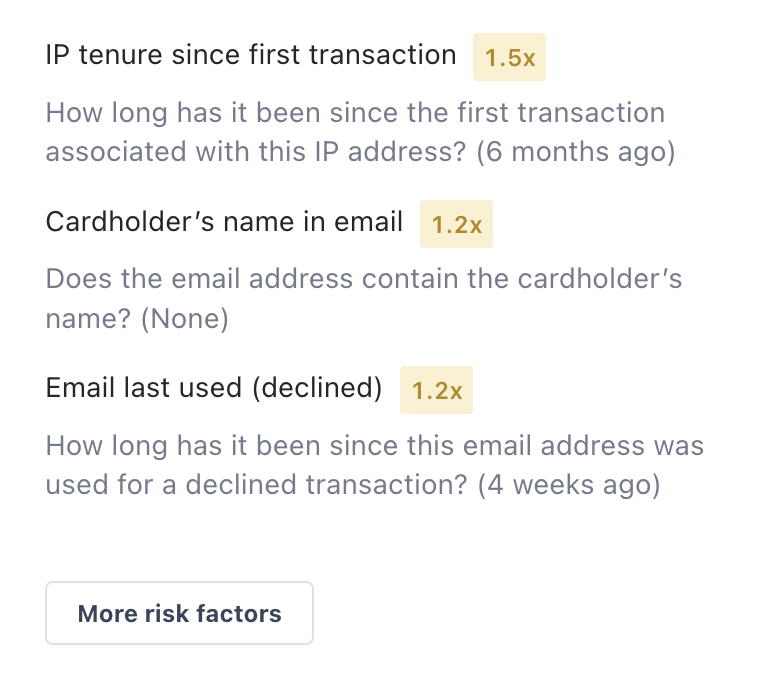

- Find the Risk Score section, which displays the score and top three factors affecting this score.

- Click More risk factors to view all the factors impacting this score.

Interpret Risk Scores

The Risk Assessment Score is a number between 0 and 1000.

Scores between 900-1000 are the riskiest, with an average of >90% of these transactions resulting in fraud.

| Score | Category | Description |

|---|---|---|

| 0-500 | Normal | No significant risk factors detected. |

| 500-750 | Medium | Some possible risk factors detected. |

| 750-1000 | High | Multiple or significant risk factors detected. |

Risk Factors

Weighted risk factors influence the risk score.

The multiplier by the factor name tells you how much this factor impacted the overall risk score.

| Score | Category | Explanation |

|---|---|---|

| <1x | Positive | Less risky |

| 1x | Neutral | Neutral risk |

| >1x | Negative | More risky |

The following factors can impact risk score:

| Factor | Description |

|---|---|

| Address verification | Does the entered credit card address match the stored address? |

| Card verification | Does the entered CVV match the stored CVV? |

| Transaction amount | How much money is involved in the transaction? |

| Number of items | How many items were purchased? |

| Credit card tenure since first transaction | How long has it been since the first transaction on this credit card? |

| Email tenure since first transaction | How long has it been since this email account was created? |

| IP tenure since first transaction | How long has it been since the first transaction associated with this IP address? |

| Credit card last used (successful) | How long has it been since the last successful card transaction? |

| Credit card last used (declined) | How long has it been since the last declined card transaction? |

| Email last used (declined) | How long has it been since this email address was used for a declined transaction? |

| Credit card authorization attempts | How many card authorization attempts were involved in this transaction? |

| Email fraudulent disputes | Has this email address been associated with fraudulent disputes? |

| Cardholder’s name in email | Does the email address contain the cardholder’s name? |

| Postal codes associated with email | How many postal codes are associated with this email? |

| Known fraudulent orders | Does Bolt have record of any past fraudulent orders? |

| Deletion behavior | Did the user display suspicious deletion behavior during checkout? |

| Input behavior | Did the user display suspicious input behavior during checkout? |

| Mouse movement | Did the user move the mouse offscreen while entering the credit card number? |